This year non-fungible tokens burst into the mainstream after several digital images and animations sold for absurd amounts – so I entered the world of NFT myself

By Oscar Schwartz

For years, I’ve kept an ever-growing record of interesting pictures I discover online in a folder entitled Images on my desktop: a fox sauntering through an art gallery; a pixelated rendering of a Tokyo streetscape; Jon Bon Jovi doing yoga.

They’re sentimental reminders of things I’ve seen online, but I am under no illusion that I somehow own these images. They come from the internet and can be copied, shared and experienced by many people all at once. My collection really is worthless to anyone but me.

Recently, however, I became aware that I can now actually own a digital image all for myself, and then potentially sell it for a profit. This class of image is called an NFT, which stands for non-fungible token. A fungible item, like a $10 note, can be traded one for another.

A non-fungible item, like a Monet painting, is unique and irreplaceable. An NFT is a digital item on a blockchain that is assigned a singular and unique ID. This means that the provenance of the image can be traced, differentiating the original from all subsequent copies – like a digital simulation of a Monet.

NFTs have been around since about 2017, but it is only this year that they have burst into the mainstream after several NFT images and animations sold for absurd amounts of money.

In February, an animated gif of Donald Trump’s naked corpse made by an artist known as Beeple sold for $6.6m – the highest price ever paid for an artwork by a millennial artist. A month later, Beeple smashed his own record, selling an NFT at a Christie’s auction for $69m.

If all exorbitantly expensive art auctions seem insane, this one completely boggles the mind. When a Damien Hurst zebra goes for tens of millions, at least the owner gets the zebra.

With an NFT, all the owner really gets is a number on a blockchain. Anyone can go online, take a screenshot of, say, the bloated Trump image, and have basically exactly the same experience that this “collector”, just without paying $6.6m.

Or am I missing something? The only way to find out, I figured, would be to enter the world myself and become a budding NFT collector.

Just as the early collectors of modern art would gather at cafes and bars in Montparnasse, NFT collectors congregate on platforms such as Twitter, Discord and Clubhouse to meet artists and analyze the field. And it was here that I met two types of NFT enthusiasts.

The first are “return on investment” NFT collectors. Unlike 20th-century art collectors, who sought rare and singular works, these collectors want to own something that is inherently replicable.

They are searching for the type of image that will spread very widely online, an image that could go viral. The more eyes that see it, the bigger the profile the artist gets, the more people want the image or similar ones. These collectors essentially trade in vibe and clout.

To get good return on investment, in other words, they try to make the NFT artists they purchase into NFT influencers.

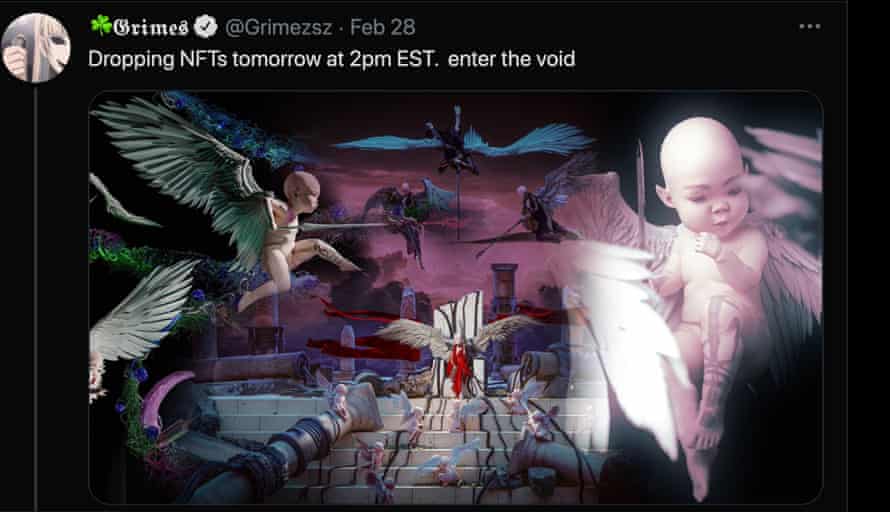

A screengrab of Grimes, Elon Musk’s partner, announcing her NFTs art on Twitter. Photograph: Twitter / @Grimezsz

These collectors almost always talk about NFT collecting in utopian terms, how they are helping foster the first “digitally native art movement”, one that is “democratic and permissionless”, or “decentralized”.

But most are also generally deeply invested in cryptocurrencies, and are early adopters who have considerable amounts of bitcoin or Ethereum. As early adopters, they are betting heavily on a future in which blockchain currency takes over, at which point, they will become incredibly rich.

NFTs, I realized, are a way to make a lot of noise about blockchain, a marketing mechanism to bring new people into this economy.

Underneath this stratum of the sophisticated NFT collectors are a huge number of clueless and eager hypebeasts who seem to have no systematic thought driving collection decisions other than whether an image is correlated with the aesthetic category of “dankness”.

As far as I could tell, a “dank” NFT was self-referential, often depicting images about tech, blockchain or meme culture; extremely colorful and visually overwhelming; and conveying “libertarian” narratives.

(While I was writing this article, Elon Musk created and put up for sale his own NFT – a golden trophy with neon lights reading “NFT” and “vanity” – which many in the community agreed was the height of “dankness”.)

I’m selling this song about NFTs as an NFT pic.twitter.com/B4EZLlesPx— Elon Musk (@elonmusk) March 15, 2021

As with anything Musk adjacent, the NFT collector world is suffused with an atmosphere of trolling and irony. It was hard to tell whether collectors really valued the aesthetics they were investing in, or just found it funny that Beeple, a 39-year-old graphic designer from Charleston, South Carolina, is now in the top three most valuable living artists.

In fact, it was perhaps this ironic quality that made the NFT world feel contiguous to the ideas of modern art. Duchamp, after all, became notorious after signing a urinal with the name R Mutt and putting it in a gallery. One hundred and four years later, a digitally rendered NFT of Duchamp’s famous sculpture is going for $5,500. Same trolly energy.

Once I had a sense of what seemed to make the NFT art world tick, it was time to visit some galleries – or, as they are known in NFT world, “marketplaces”.

I spent a good few hours perusing my options at Opensea, Rarible, NiftyGateway, NFT Showroom and hicetnunc, scrolling past images of sirens playing Nintendo Switch surrounded by green and blue jellyfish; an astronaut on a tropical island playing a grand piano; one bitcoin having sex with another bitcoin; Van Gogh’s self-portrait with a Doge face instead of his own.

I wanted to purchase something as “dank” as possible, which seemed to be the purest expression of the medium. I eventually found it: a truly horrendous gif representation of Musk created by an artist known as Punky_Funky.

He is wearing a blue disposable face mask, his eyes glowing the color of the rainbow, wearing a large gold bitcoin chain around his neck, standing in front of a rotating moon, with colorful letters in the background reading: “I am Mask.” It cost me 0.0005 ETH, or 75 cents.

Once the image was in my Ethereum wallet, I didn’t particularly feel like I owned it any more than the other screenshots in my Images file. But I did feel a nihilistic rush – the thrill of abstract money moving around.

This, however, comes at a real cost. Environmentally, NFTs are a disaster. Some estimate that putting my stupid Musk image on the blockchain uses the equivalent of the average monthly energy use of an American citizen.

So, how to make sense of an art craze that is basically Beanie Babies that also burns rainforests? Some say that NFTs are an early expression of a whole new decentralized economy, where ownership and trading is done person to person.

But it strikes me as significant that the boom in NFTs is happening at the tail end of the pandemic. Similar to the GameStop stock market boom earlier this year, it seems to signify a creeping despair about the state of the world and a desperate desire to get rich before the new future begins.

We thought that at the end of all this we might leave our rooms and go back out with a renewed appreciation for the world. Instead, it seems like we may have become accustomed to our screens, no longer entirely sure how to differentiate the two.

Source: The Guardian

Startup: Only Quantum Cryptography Can Save The $100 Trillion Global Digital Economy

Security startup Verkada hack exposes 150,000 security cameras in Tesla factories, jails, and more

Largest compilation of emails and passwords leaked for free on public forum